34+ Estimated home mortgage calculator

For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

With our switching mortgage calculator its easy to find out how much you could save.

. Online mortgage amortization calculator estimated results page. For mortgage loans excluding home equity lines of credit it includes the interest rate plus other charges or fees. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

The annual guarantee fee is reflected in the estimated payment above. Find out more here. If the estimated repayment amount is more than you can afford you could consider lowering the amount you wish to borrow or looking for a cheaper property.

Mortgage Home Equity and Equity Line of Credit. Property taxes are generally estimated at 12 of. Balance on your.

2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates. New home loans with a minimum application amount of 100000. Answer a few simple questions and in less than one minute well calculate the monthly and overall savings you could make by switching your mortgage to the best available rate available to you.

Choosing the right mortgage can help make your home buying. The annual fee is 35 which is 5892 each month for your selections. Home Value - This is the estimated value of your home or.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. NerdWallets mortgage amortization schedule calculator can help you do all of those things. This mortgage calculator with extra payment allows you to add extra contribution to every payment.

One can enter the PMI as a dollar amount or as a percentage of the home value. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. Estimate your monthly payment with our Mortgage Calculator.

Up to five recurring or up to ten one-time lump sum payments. PMI protects the lender in case you default on the loan. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022. Refinancing is not the only way to decrease the term of your mortgage. Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000. For home equity lines the APR is just the interest rate.

Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance. Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. To give you a better idea lets say the conforming limit for a 2-unit house in your area is 702000.

Offset savings example calculation. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. Using our mortgage rate calculator with PMI taxes and insurance.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

At a 4875 interest rate the APR for this loan type is 4875. It can also be used to help fill steps 3. Not be satisfied early in lockdowns along with buyers responding to falling interest rates and new needs in a work-from-home economy.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. Estimated value of your home.

A new mortgage guarantee. Use our mortgage repayment calculator to get a quick estimate of your monthly payments for your loan. Lets say you are 3 years into a 30-year 500000 home loan with a 100 offset account which you havent yet added any savings toYou have built up some money.

The mortgage calculator with taxes and insurance allows a borrower to include property taxes and homeowners insurance so that one can get a complete breakdown of the amortization schedule and see. Your total interest on a 100000 mortgage. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

If you took a mortgage at 500000 for a 2-unit home it is considered a conforming loan. Scroll down to view the mortgage amortization schedule. Estimated monthly payments do not include taxes and insurance which will result in a higher monthly payment.

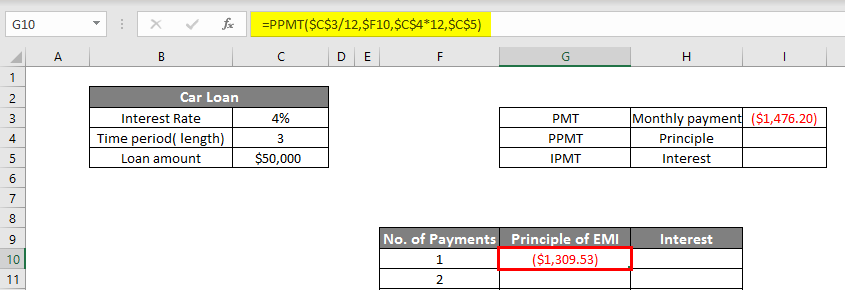

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Get Your Custom Rate. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan. However if you exceed the 702000 loan limit your mortgage will classified as a non-conforming conventional loan. Included in the calculator is the USDAs annual mortgage insurance.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. The cost of PMI varies greatly depending on the provider and the cost of your home.

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Home Buying

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Payoff Pay Off Mortgage Early Mortgage Loan Originator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

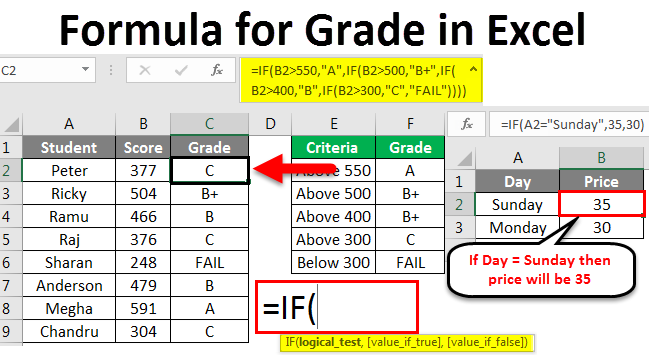

Formula For Grade In Excel How To Use Formula For Grade In Excel

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

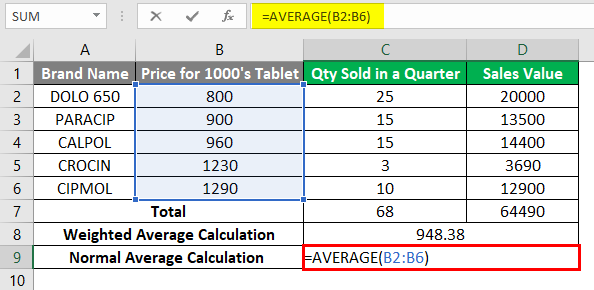

Weighted Average In Excel How To Calculate Weighted Average In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Calculate Compound Interest In Excel How To Calculate

Mortgage Calculator Calculate You Montly Payments On Your Mortgage How Much Interest Will You P Mortgage Payment Calculator Mortgage Tips Mortgage Calculator

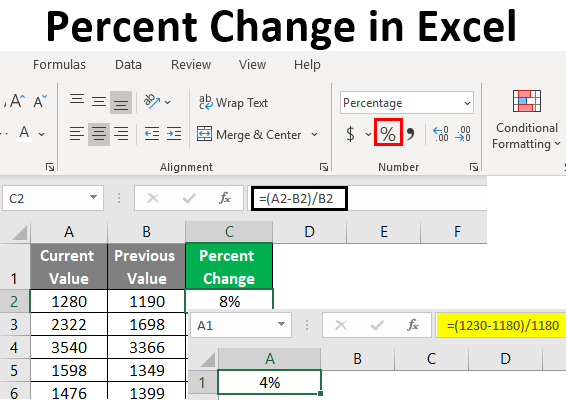

Percent Change In Excel How To Calculate Percent Change In Excel

Komentar

Posting Komentar